Editor’s Notice: This story initially appeared in On Balance, the ARTnews e-newsletter in regards to the artwork market and past. Sign up here to obtain it each Wednesday.

Because the artwork market has muddled by means of its years-long droop of late, the marquee auctions have change into workout routines in harm mitigation. Collectors appear content material to stay on the sidelines whereas the public sale homes hustle to coax them again into the sport, whether or not as consignors or bidders.

That’s one main purpose why Christie’s assured all 39 heaps in its inaugural sale of the season, “Leonard & Louise Riggio: Collected Works,” on Monday night time. The technique may not be horny, nevertheless it labored: the sale introduced in $272 million, in opposition to a low estimate of $252 million. The twentieth century artwork sale that adopted brought in an additional $217 million on a low estimate of $194 million, with 15 of the 35 heaps carrying third-party ensures. (All quoted costs embody purchaser’s charges.)

“There’s much less pleasure for individuals within the salesroom, however guaranteeing heaps is a pure alternative in an unsure financial market, particularly for the most important estates,” stated Jussi Pylkkänen, former international president of Christie’s and founding father of the London-based advisory Artwork Pylkkänen, talking to ARTnews on Tuesday.

To Pylkkänen, the variety of works going to 3rd events in Monday’s sale signaled “extremely exact judgment and efficiency” by Christie’s specialists in pricing the works—even when the estimates have been “sturdy.”

“Keep in mind, the third events are bidders and actual collectors, and so they’re shopping for on the costs beneficial by the home,” he stated.

Piet Mondrian’s Composition with Massive Purple Aircraft, Bluish Grey, Yellow, Black, and Blue (1922), which as soon as adorned the vestibule of the Riggios’ Park Avenue condo, stole the present. Whereas it fell wanting the artist’s $51 million public sale file, it got here shut: the $47.6 million sale marked the third-highest worth ever paid for a Mondrian at public sale.

Pylkkänen stated the end result mirrored present demand for “stunning objects versus extra mental works.”

“For each the day and night gross sales, essentially the most engaging objects by main artists are eliciting extra competitors than normal,” he added, citing a Henri Matisse charcoal on paper that bought effectively above its excessive estimate throughout Christie’s day sale of Impressionist and fashionable works on paper on Tuesday.

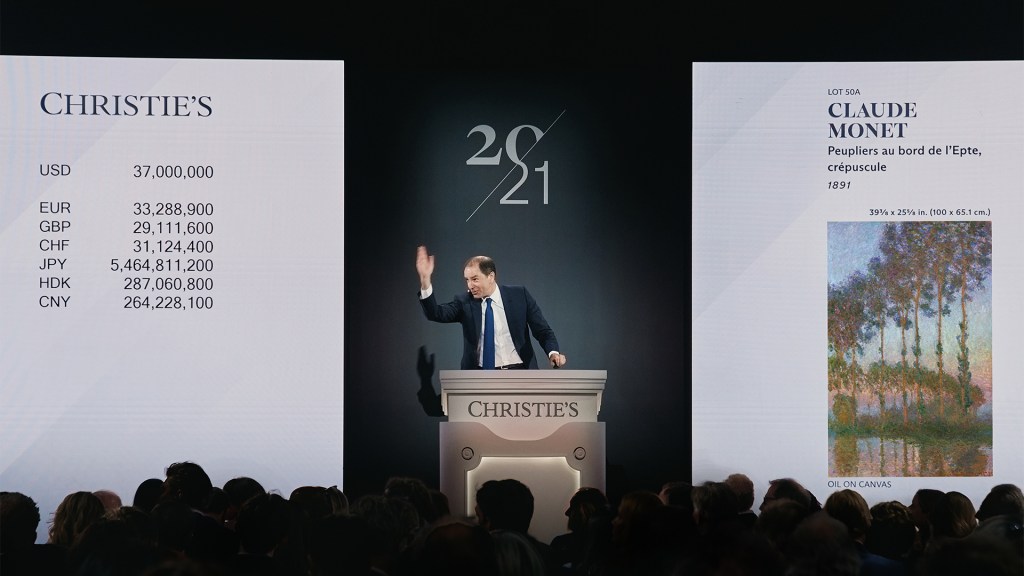

Christie’s twentieth century artwork night public sale was led by Claude Monet’s Peupliers au bord de l’Epte, crépuscule (1891), which fetched $49.2 million—simply shy of its $50 million excessive estimate. Mark Rothko’s No. 4 (Two Dominants) [Orange, Plum, Black], 1950–51, from a bunch of 9 works consigned by Sid and Anne Bass, introduced almost $39 million.

In complete, the 2 gross sales generated $489 million for Christie’s—not a end result to smell at in a gentle market. Afterward, Rachel White Younger, co-head of the twentieth century artwork night sale, stated she was “thrilled by such a constructive reception from the market.”

Alex Glauber, founding father of New York–based mostly AWG Artwork Advisory, characterised the night time as strong—however extra respectable than distinctive given present circumstances.

“Christie’s had the unenviable job of going earlier than Sotheby’s this week,” he informed ARTnews, noting that going second usually permits for adjusted expectations and estimates. “What’s clear is that we’re nonetheless in a tempered atmosphere, and the home needed to handle its danger accordingly—which it did with loads of third-party ensures.”

Ensures might guarantee bought heaps, however the draw back, Glauber reminded, is “toned-down bidding exercise.”

Nonetheless, Monday wasn’t with out drama. Two Warhols have been pulled from the sale earlier than they reached the block. Philip Hoffman, founder and CEO of the Positive Artwork Group, informed ARTnews in an electronic mail that the withdrawals “spotlight the continued problem of promoting higher-quality works at public sale.” Extra sellers, he added, are turning to the personal market.

Tuesday introduced one other instance of the dangers concerned in promoting top-end works and not using a assure. The quilt lot for Sotheby’s fashionable artwork night sale—Alberto Giacometti’s much-hyped Grande tête de Diego (1955)—carried a $70 million estimate however no third-party backing. Sotheby’s chief auctioneer and Europe chairman Oliver Barker opened the bidding at $59 million and nudged it to $64 million earlier than withdrawing the lot after 4 minutes with no sale. (It’s believed the reserve was set on the $70 million estimate.)

The sale brought in $186.4 million throughout 60 heaps, half of which have been recent to market. Fifty works bought, and 40 % of them exceeded their excessive estimates. Pablo Picasso’s Homme assis (1969) achieved $15.1 million (excessive estimate: $18 million), whereas Georgia O’Keeffe’s Leaves of a Plant (1942) attracted almost 30 bids earlier than promoting for $13 million (excessive estimate: $12 million). A Frank Lloyd Wright double-pedestal gentle fixture—formed like a miniature Artwork Deco gazebo—softened the blow of the unsold Giacometti. It fetched $7.5 million, 4 instances its final public sale worth in 2002.

Giacometti apart, the end result was strong given the cool market, as was the case at Christie’s the night time earlier than. However did Sotheby’s profit from going second, as Glauber and Pylkkänen recommended?

After Tuesday’s sale, Julian Dawes, Sotheby’s head of Impressionist and fashionable artwork, declined to take a position.

“The very fact is that—with catalogues out in good time, and with long-running pre-sale exhibitions—collectors have the complete image earlier than the season begins, so their plans are largely made effectively earlier than the primary hammer falls,” he informed ARTnews. “Finally, we’re all the time glad to see sturdy outcomes wherever available in the market, and there have been an excellent quantity this week, together with in final night time’s sale.”

The image at Phillips, nonetheless, was much less rosy. On Tuesday, its fashionable and modern night sale introduced in $52 million—precisely the low estimate. However enthusiasm ought to be tempered: that complete represents a 40 % drop from final Might’s $86 million equal.

Regardless of the gentle end result, Phillips set five new artist records, all for girls. They included ones for Kiki Kogelnik, with a figurative portray by her promoting for $280,000—almost double its excessive estimate—and Ilana Savdie, who had a portray that bought for $180,000 (excessive estimate: $100,000).

With night gross sales nonetheless to return tonight and Thursday, we sit squarely at halftime. Whereas surprises are all the time attainable, the remaining auctions are more likely to comply with the prevailing narrative: “regular, nonetheless stratified, and leaning arduous on confirmed names,” as ARTnews’s Daniel Cassady and Karen Ho wrote on Monday.